After you type an LLC in The us, you safe restricted personalized legal responsibility, which shields your assets from business debts and lawsuits. You’ll find that the entity offers adaptability in tax treatment method and streamlines administration with fewer formalities than organizations. These functions may make operations successful and hazard much more manageable. On the other hand, the benefits don’t end there; you’ll also uncover chances that improve the name and viability of your organization.

## Confined Personal Liability Protection

One Main advantage of forming an LLC will be the limited individual legal responsibility defense it provides.

Once you set up an LLC, your personal belongings—for instance your own home, auto, and lender accounts—are usually shielded from the organization's debts and legal obligations. Creditors frequently are not able to pursue your individual house to satisfy business liabilities or judgments.

This lawful separation implies you aren't Individually liable for claims arising from your online business, supplied you adhere to statutory requirements And do not engage in fraudulent functions.

## Flexible Taxation Solutions

Over and above limited liability security, an LLC distinguishes by itself by offering important flexibility in how it's taxed.

You may elect to own your LLC taxed website for a sole proprietorship, partnership, S corporation, or C Company, according to possession construction and money technique. This option allows you to improve your fiscal duties and align tax procedure with enterprise plans.

Pass-by way of taxation is the default, enabling revenue and losses to circulation straight to users, Therefore averting double taxation. Alternatively, company taxation may supply strengths in sure situation.

This adaptability empowers you to definitely tailor your tax obligations, maximizing both profitability and operational efficiency.

## Streamlined Management and Compliance

Although firms generally facial area rigid hierarchies and in depth formalities, an LLC provides streamlined management structures and simplified compliance requirements.

You are able to designate members or managers to supervise functions with no obligatory boards or officer appointments. Working agreements grant you flexibility to structure governance and administration techniques tailor-made to your small business demands.

Ongoing compliance is straightforward—once-a-year stories and charges are often nominal, with fewer required meetings or record-holding obligations. This efficient administrative system allows you to give attention to Main organization operations.

You’ll take pleasure in diminished bureaucratic oversight, permitting you to definitely allocate time and sources to scaling your business in lieu of paperwork.

## Conclusion

By forming an LLC, you safe limited personalized liability, safeguarding your belongings from enterprise obligations. You’ll benefit from versatile taxation, permitting you choose essentially the most beneficial tax regime to your scenario. The streamlined management and compliance requirements signify you are able to run your business proficiently with lessened red tape. Eventually, creating an LLC not only enhances your online business’s lawful standing but additionally strengthens your capability to bring in shoppers, partners, and expense in a competitive Market.

Michael J. Fox Then & Now!

Michael J. Fox Then & Now! Molly Ringwald Then & Now!

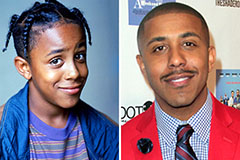

Molly Ringwald Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Michael Fishman Then & Now!

Michael Fishman Then & Now! Stephen Hawking Then & Now!

Stephen Hawking Then & Now!